By Tahir Awan, SEO Expert & Content Marketing Strategist 10+ Years in Health/SaaS/Tech Industries, SERPK

Entrepreneurs know that smart decisions require clear financial data. Great ideas can fail without solid numbers: nearly half of new businesses fail within five years due to cash-flow issues and poor budgeting. Business owners can spot problems early and avoid costly mistakes by keeping organized records of every dollar coming in and out. Financial data knowledge prevents surprises and empowers growth planning.

What Is Small Business Expense Tracking?

To ensure financial transparency and control, businesses must track, categorize, and monitor all expenses. Expense tracking helps organizations understand spending patterns, identify waste, and make informed cash flow decisions.

Small Business vs. Enterprise Expense Tracking

Expense tracking may seem universal, but how it’s managed—and what’s at stake—differs significantly between small businesses and large enterprises.

In larger organizations, expense tracking is typically structured, automated, and supported by dedicated finance teams and established workflows. Small businesses, by contrast, often manage expenses manually, inconsistently, and with limited staff—sometimes by a single individual. This difference makes small business expense tracking both more challenging and more critical.

Why Does Small Business Expense Tracking Matter?

Small businesses often don’t realize the cost of inefficient expense tracking until it’s too late. Here’s what’s at stake:

Cash flow surprises from untracked expenses: Small businesses depend on steady cash flow. When expenses aren’t tracked in real time, overspending can go unnoticed, leading to shortfalls, late payments, or worse.

SaaS creep and unnecessary costs: SMBs rely on many software tools, but subscriptions can accumulate without proper oversight. Just ten $20/month tools add up to $200 per month—or $2,400 per year—potentially wasted on unused software.

SaaS spending is a major challenge for SMBs. Teams subscribe to new tools, and without a system in place, businesses lose visibility into what’s actually being used. — Jayanti Katariya, CEO of Moon Invoice

Missed growth opportunities: Without clear expense visibility, financial decisions become guesswork. Hiring, expansion, and marketing initiatives carry unnecessary risk instead of being guided by data.

Tax season complications: Last-minute receipt searches, expense categorization, and identifying deductible costs can lead to missed deductions, reporting errors, and potential penalties.

These challenges mirror the need for automation seen in mortgage loan origination software, where accurate financial tracking and compliance are essential.

3 Best Practices for Streamlining Business Expense Tracking

1. Implement Expense Tracking Software

Choosing the right expense tracking software can significantly improve financial operations. Look for solutions that integrate seamlessly with existing systems to ensure a smooth transition. Digital receipt uploads and automated data entry reduce errors and save time.

Mobile capabilities are essential, allowing employees to submit expenses from anywhere and encouraging timely, accurate reporting. Scalable solutions that support additional users and data are also important as the business grows.

Advanced platforms increasingly use artificial intelligence to categorize expenses, enforce spending policies, and surface predictive insights. These tools simplify workflows while supporting smarter financial decision-making.

2. Establish Clear Expense Policies

Well-defined expense policies promote transparency and compliance. Start by outlining clear spending guidelines and approved expense categories. This clarity reduces discrepancies and aligns spending behavior with business goals.

Effective communication is key. Share detailed guidelines and provide training to reinforce understanding. Modern expense tools support policy enforcement through dashboards, automated approvals, and real-time alerts, reducing manual oversight while improving accountability.

3. Utilize Automated Expense Reporting

Automated expense reporting improves both efficiency and accuracy. By eliminating manual data entry, businesses reduce errors and accelerate reporting cycles, allowing finance teams to focus on higher-value initiatives.

Real-time tracking keeps financial data current and reveals spending trends as they emerge. Advanced accounts payable systems streamline approvals, while AI-powered tools identify anomalies and patterns that support more proactive financial management.

Expense Tracking Tools

TrackMySubs

Best for: Subscription management

G2 rating: 4.6 / 5 stars, based on 199 reviews

Key Features

- Subscription tracking: Track billing cycles, amounts, and payment methods in one dashboard.

- Pre-renewal alerts: Get automatic notifications to cancel, modify, or continue a subscription.

- Spending insights: Visualize monthly and annual spending, identify underused tools, and cut costs.

- Budget management: Set monthly or annual spending limits and receive notifications when you reach them.

- Custom notes and categories: Sort subscriptions by category (Marketing, Design, Utilities) and note logins, promo codes, and cancellation policies.

- Share access with team members or departments to track company-wide subscriptions and ensure transparency.

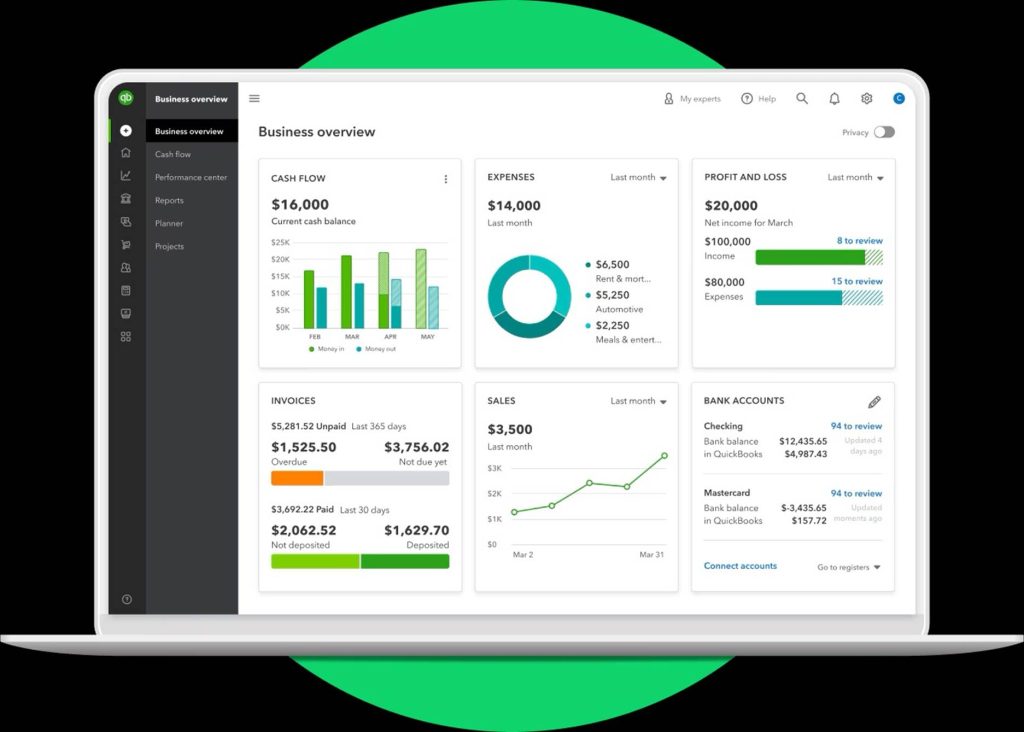

QuickBooks

Best for: Small business accounting

G2 rating: 4 / 5 stars, based on 3000+ reviews

Key Features

- Track expenses: Automatically categorize, capture receipts via the mobile app, and sync with bank accounts.

- Customize invoices, send payment reminders, and accept online payments through QuickBooks.

- Financial reporting: Monitor business health with real-time financial reports, cash flow statements, and tax summaries.

- Automate payroll, tax calculations, and employee direct deposits.

- Automatically reconcile bank accounts and credit cards to reduce manual errors.

- Integrations with third parties: For easy financial management, integrate PayPal, Stripe, and eCommerce platforms.

Expensify

Best for: Automated expense reporting

G2 rating: 4.5 / 5 stars, based on 5,000+ reviews

Key Features

- Per diem management: Sets daily allowances for employees traveling for work and automatically calculates and applies per diem rates based on company policies.

- Custom policy controls allow organizations to limit spending, flag policy violations, and enforce compliance with automated rules.

- Managers or assistants can submit, approve, or manage expenses for others, streamlining team workflows.

- Direct deposit: Allows employees to receive ACH reimbursements for approved expenses.

- Compliance tools: Automated audit trails and AI-powered compliance checks detect duplicate receipts, policy violations, and fraud.

Zoho Expense

Best for: Travel expense management

G2 rating: 4.5 / 5 stars based on 1000+ reviews

Key Features

- Sync and match corporate card transactions automatically to reduce manual reconciliation.

- Automate per diem rates for employees traveling across regions to ensure accurate reimbursements.

- Direct vendor payments: Avoid separate payment processing by paying vendors from Zoho Expense.

- Custom reports and advanced analytics: Create custom reports on expense trends, policy violations, and departmental spending.

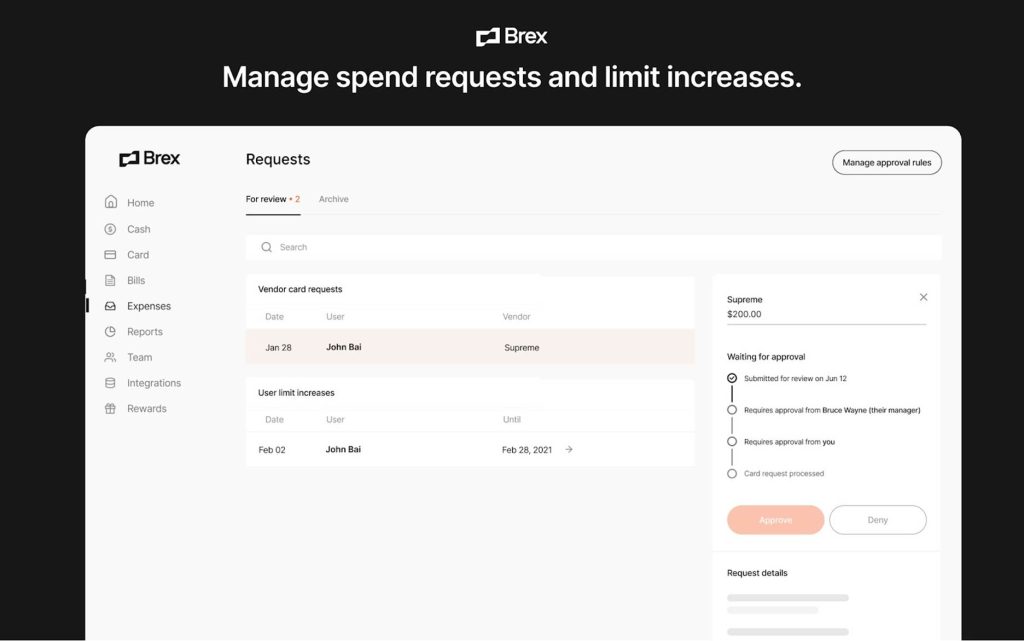

Brex

Best for: Integrated corporate banking and expense management

G2 rating: 4.7 / 5 stars, based on 1000+ reviews

Key Features

- Business owners aren’t personally liable for debt with Brex, unlike traditional corporate cards.

- Instead of credit scores, Brex dynamically sets credit limits based on cash flow, revenue, and financial stability.

- Businesses can issue instant virtual cards for employees and online purchases, reducing fraud and improving security.

- Integration of partnerships: Simplifies travel, banking, and financial workflows with Navan and Stripe Atlas.

Conclusion

Effective small business expense tracking is not just about recordkeeping. It’s about visibility, control, and confidence in financial decisions. When expenses are tracked accurately and consistently, businesses gain the clarity needed to protect cash flow, reduce waste, and plan for growth. By combining clear policies, automation, and the right tools, small businesses can turn expense tracking from a reactive task into a strategic advantage.

Author Bio

Tahir Awan is a passionate SEO Expert and Content Marketing Strategist at SERP Klicks, having 10 years of industry experience. I believe that powerful storytelling combined with data-driven insights can transform brands by creating content that not only ranks but also resonates with audiences. From building effective link-building campaigns to designing content strategies that drive sustainable growth, Tahir’s approach is rooted in creativity, research, and data insights. His work spans industries like healthcare, SaaS, and technology — helping businesses